Though it might often go unnoticed and underappreciated, the truth is, without bookkeeping, businesses could face financial mismanagement, non-compliance penalties, and operational chaos. Recognising and valuing its essential role is crucial for the longevity and success of any enterprise.

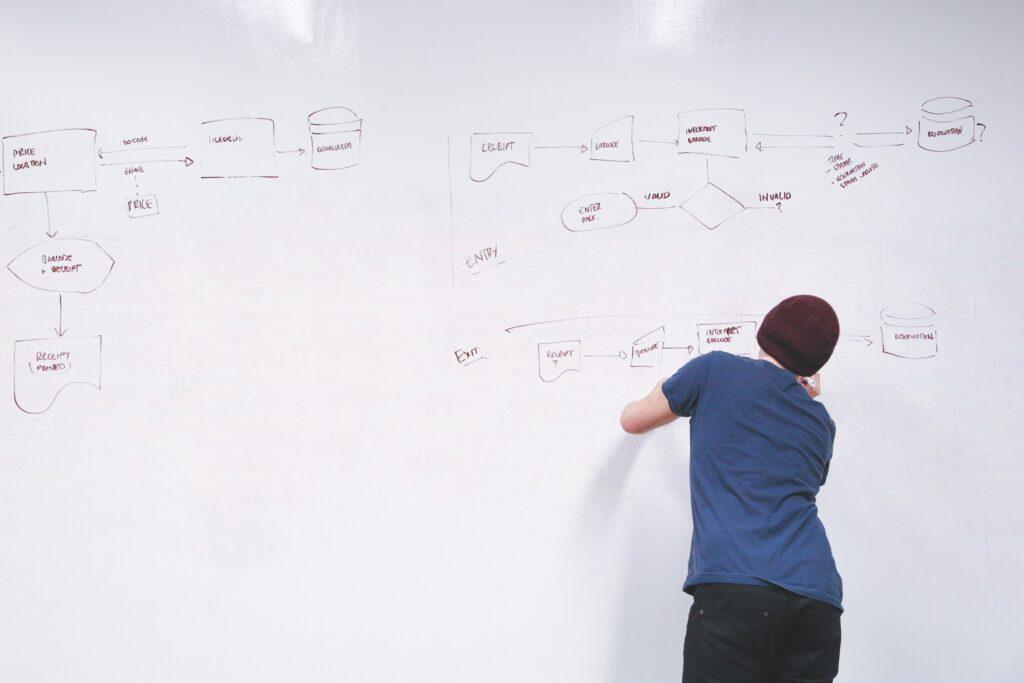

But here’s the thing, there’s no shortcut to success. You need solid processes. Imagine building a house on sand — looks great for a while, but eventually, it’s going to collapse. Similarly, processes in bookkeeping are your bedrock that keep your financial house in order.

So what is the basic bookkeeping process? There are five basic steps: 1) collecting financial transactions; 2) categorising transactions; 3) recording transactions in journals; 4) posting to ledgers; and 5) preparing financial statements.

What is the basic bookkeeping process?

1) Collecting financial transactions

This first step isn’t just about hoarding receipts in a shoebox. It’s about knowing exactly where your money is going, whether it’s on a joyous coffee run for the team, the lunch meal you bought for your client, or your investment that cutting-edge bookkeeping software.

Without a clear and accurate record of every transaction, you’re basically navigating your finances blindfolded. Banks and tax institutions won’t like that.

Start with a system – whether it’s digital or manual, find what suits your style. Regularity is key. Make it a habit to record transactions as they occur. It might seem tedious, but I promise that the clarity it brings to your financial health is worth its weight in gold.

Related articles:

What Does a Bookkeeper Do All Day?

Is Bookkeeping Same as Accounting?

2) Categorising transactions

Each transaction you make has a unique nature. Whether it’s an expense, income, asset, or liability, you need to assign it to the right category so you can easily analyse and interpret your financial data. You’ll also have a better understanding of your spending habits, purchasing trends, as well as opportunities for growth and cost-cutting.

Be consistent. If you categorise a certain expense under “Marketing” in January, don’t toss it under “Miscellaneous” in March. Another thing: As your business operations evolve, so should your categories. Some might be irrelevant down the line or perhaps too broad/specific for your taste.

3) Recording transactions in journals

Every transaction, once categorised, needs to be journaled. This means detailing the transaction, identifying the accounts affected, and documenting the amounts. The journal serves as a chronological record – a financial diary if you will – that traces the journey of every dollar. It’s your one source of truth when it comes to making strategic decisions.

Pro tip

The devil is in the detail. Document diligently, and leave no room for ambiguity. This will pay off when you need to review or audit your financial records.

4) Posting to ledgers

Imagine you’ve made several transactions today – you bought coffee, paid a bill, and received your paycheck:

Sorting transactions

Posting to the ledger is like taking the key details of these stories (amount, type, date) and organising them into their respective folders – one for expenses, one for income, etc.

Debits and credits

In each folder, we note whether money is coming in (credit) or going out (debit). So buying coffee is a debit in the expense folder, and receiving a paycheck is a credit in the income folder.

Balancing the books

After sorting, we make sure that the total money coming in matches the total money going out. This is a quick check to ensure we haven’t missed anything.

Ready for reporting

With all transactions posted in their respective folders (ledger accounts), we can easily see the total income, expenses, and therefore, the profit or loss.

Pro tip

Double-check! Always double-check your entries when posting to ledgers. A small error can have a big impact, so take the time to ensure accuracy and alignment with your journal entries.

5) Preparing financial statements

Income statement

This is like a performance report card. Your income statement summarises revenues and expenses, thus showing the net income or loss for a specific period.

Revenues: Add up all the money earned (sales, services rendered, etc.).

Expenses: Sum all the costs incurred (rent, salaries, utilities, etc.).

Net Income/Loss: Subtract total expenses from total revenues.

Balance sheet

This is a snapshot of a company’s assets, liabilities, and equity at a specific point in time.

Assets: Everything the company owns (cash, inventory, equipment, etc.).

Liabilities: All the company owes (loans, payables, etc.).

Equity: The net assets belonging to the owners (initial investment, retained earnings, etc.).

Balance: Assets = Liabilities + Equity.

Cash flow statement

This shows how changes in the balance sheet and income statement affect cash. In other words, you get to see cash outflows and inflows.

Operating Activities: Cash from the main business operations.

Investing Activities: Cash used or received from investments (buying/selling assets).

Financing Activities: Cash exchanges with owners and creditors (loans, dividends, etc.).

Statement of equity

This details the changes in owners’ equity over a period.

Beginning Equity: Equity at the start of the period.

Add: Contributions from owners, net income.

Subtract: Withdrawals by owners, net loss.

Ending Equity: Equity at the end of the period.

After preparing these statements, they’re reviewed, adjusted if necessary, and then finalised for presentation to stakeholders. These statements provide a comprehensive view of the financial health of a company, allowing everyone – managers, investors, and other stakeholders – to be on the same page.

Why processes are important in bookkeeping

Time is money. And in the business world, efficiency is the fuel that keeps the engine running. Streamlined bookkeeping workflows enable routine tasks to be executed swiftly and effortlessly. This not only saves valuable time but also allocates resources more effectively.

Having structured processes also allows for consistency. It’s like having a recipe when you’re cooking. It ensures that whether you’re preparing the dish today or a month from now, or whether it’s you or someone else, the outcome will be the same. This is particularly important in a business setting where multiple people might be involved in bookkeeping.

In essence, without well-established processes, bookkeeping would be prone to errors, inconsistencies, and inefficiencies, making it challenging to get a clear and accurate picture of a company’s financial situation.

Related articles:

Is Bookkeeping a Dying Profession?

How to Hire the Right Bookkeeper: 5 Important Questions to Ask

Say goodbye to outdated financial workflows with The Bookkeeping Studio

Bookkeeping might not have the allure and flashiness associated with some other aspects of business, such as marketing campaigns, product launches, or high-profile partnerships. However, it’s truly the backbone of any business. Just like the gears inside a watch, it’s what keeps the wheels turning and the engine running.

With all that said, bookkeeping may not be the most glamorous part of business, but it is undeniably foundational. That’s why our team at The Bookkeeping Studio works tirelessly behind the scenes to make sure that our work genuinely adds value to our clients’ brands. Experience the benefits of financial stability and better cash flow today.